By Pete the Banker

The Media celebrated increases in August Home Sales. However, housing experts continue to warn of a double dip in housing with the expiration of the first time home buyers tax credit last Spring and the increasing supply of homes on the market in large part due to continuing loan defaults and the failed Government Home Affordable Modification Program (HAMP) which threaten to derail a sustained economic recovery.

Even Freddie Mac admitted concern with a grim housing forecast for this quarter. “Freddie Mac expects third quarter new and existing home sales to reach an annualized rate of 4 million, a possible 20.7% decline from last year and 23% drop from the previous quarter.” and “In its September economic outlook, Freddie said recent reports of plummeting home sales and near record-high delinquencies has shaken confidence in the “fragile” housing recovery.” HERE.

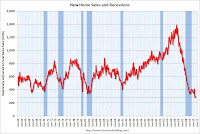

Even Freddie Mac admitted concern with a grim housing forecast for this quarter. “Freddie Mac expects third quarter new and existing home sales to reach an annualized rate of 4 million, a possible 20.7% decline from last year and 23% drop from the previous quarter.” and “In its September economic outlook, Freddie said recent reports of plummeting home sales and near record-high delinquencies has shaken confidence in the “fragile” housing recovery.” HERE.Following the massive 27% decline in existing home sales and 12.5% decline of new home sales in July, a tepid August recovery in housing sales numbers seem to support Freddie Mac’s contention.

“Existing home sales increased by 7.6 percent in August to a seasonally adjusted annual rate of 4.13 million units from an upwardly revised 3.84 million units in July (previously reported as 3.83 million units). This remains 19.0 percent below the sales pace in August 2009.” HERE.

“Existing home sales increased by 7.6 percent in August to a seasonally adjusted annual rate of 4.13 million units from an upwardly revised 3.84 million units in July (previously reported as 3.83 million units). This remains 19.0 percent below the sales pace in August 2009.” HERE. And new home sales finished at same level as July, “The 288 thousand annual sales rate for August is just above the all time record low in May.” HERE.

According to the Mortgage Bankers Association, the total housing inventory for August represents an 11.6 month supply but isn’t far below only Julys record supply of over 12 months. According go the Calculated Risk Blog, The Federal Government now admits that, “HAMP was mostly a foreclosure delaying program.” HERE. Most HAMP participants never get beyond temporary modification status and those entering permanent loan modification face very high cancellation/redefault rates within 18 months after modification.

Declining housing sales and the increasing inventory of foreclosed homes will continue to pose a significant drag on economic recovery regardless of the cheerleading Media headlines. Until the housing market finds its equilibrium absent Federal Government interference, the housing industry which has historically lead us out of recession will continue to subdue or delay national economic recovery.

Tell ’em where you saw it. Http://www.victoriataft.com