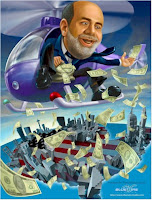

“The central bank chairman stunned financial markets Wednesday when he told Congress that the next round of stimulus—much like objects in the rear-view mirror—is closer than it may appear. (here)”

Dear Chairman Bernanke,

Thank you so much, Chairman Bernanke for your consideration of the renewal of quantitative easing! We have really had a really tough time this year trying to make ends meet, with declining profits, layoffs and all (here). We Wall Street Bankers and Investment Bankers would really appreciate your help in supplementing our year end profits/ bonuses (here). We would certainly welcome and eagerly embrace any renewed stimulus.

And we’re pretty sure it we wouldn’t promote additional inflationary pressure on food and oil prices. Since the economy has slowed dramatically over the Spring months, we wouldn’t be lending the money out or investing it any time soon even to those truly credit worthy small businesses or individuals who really need it. It’s just too risky.

We would probably just continue to invest it in 10 year Treasuries yielding 3% +/- while paying you that onerous Federal Reserve charge of 1/4%. That’s probably way too costly by the way. But I guess we could manage with a risk free return of 2.75% which should help our bottom line a little. That’s especially true since we can execute Treasury purchases and sales with the touch of a button and won’t even need to hire any additional personnel.

What would we possibly do without your help, Ben? It certainly would be tougher too earn a subsistence living?? Thanks again for your consideration and past generosity!

Sincerely,

Your Ever Grateful New York Banking and Investment Banking Friends

Tell ’em where you saw it. Http://www.victoriataft.com