Price alone doesn’t tell the story about the country’s housing industry.

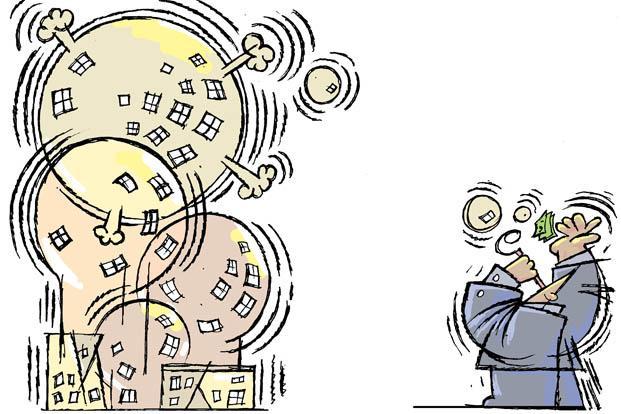

The housing industry is looking at another bubble thanks to institutional investors buying up properties and inflating the properties for themselves. But the media haven’t caught on. The latest MSM story line about the ‘improvement’ in the housing industry considers only one part of the story. All of the coverage is price based. The stories don’t cover sales activity and specifically sales to owner occupants. Those numbers have not recovered despite billions thrown at the market since President Obama took office in 2009. One day, investors are going to tire of buying and renting houses. Markets where prices have gone up dramatically, like Las Vegas and Phoenix, are likely to crash again.

All of the coverage is price based. The stories don’t cover sales activity and specifically sales to owner occupants. Those numbers have not recovered despite billions thrown at the market since President Obama took office in 2009. One day, investors are going to tire of buying and renting houses. Markets where prices have gone up dramatically, like Las Vegas and Phoenix, are likely to crash again.

One day, investors are going to tire of buying and renting houses. Markets where prices have gone up dramatically, like Las Vegas and Phoenix, are likely to crash again.

The Mortgage Bankers Association reports confirms the suspicions about another bubble.

Fitch Ratings, New York said such growth [in price] is “unsustainable.” Fitch Director Stefan Hilts said the company’s Sustainable Home Price model suggests national prices are 17 percent overvalued, including many markets in California.

“Home prices in San Francisco have gone up over 20 percent year-over-year, the highest rate of increase than at any point in the last 10 years,” Hilts said. “In fact, San Francisco and San Jose will set new home price records in the next six months.”

The SHP model currently identifies much of coastal California to be more than 20 percent overvalued. Other California cities nearing bubble-year peaks include Oakland, San Diego and Los Angeles

Ironically, had we not had massive government intrusion, I suspect the correction would have been more severe initially, but would have been of far shorter duration and an ancient memory by now.

On the Fannie and Freddie front, the market reformers seem to be backing off real reform. Nine Congressmen, eight Democrats and one Republican, have sent a letter to the Federal Finance Housing Agency (FHFA) urging more government support for multifamily housing. It’s an institutional giveaway. Believe me, there is no dearth of private capital to serve the apartment market.

Here we go again.