This post is perfectly appropriate for conservatives as well but they already know this stuff. For you liberal/progressive types I’m just going to take five minutes of your time to knock down two whoppers Obama/Pelosi/Reid have been dishing for years. If you care about intellectual honesty you’ll indulge me.

The following comments appear in the President’s fiscal cliff “victory” talking points disseminated today (find them here). (Find the details of the compromise here)

According to the President the fiscal cliff deal passed by the Senate (but as of this writing not the House) features:

Raises $620 billion in revenue according to Congress’ Joint Committee on Taxation by achieving the President’s goal of asking the wealthiest 2 percent of Americans to pay more while protecting 98 percent of families and 97 percent of small businesses from any income tax increase.

Forget the (probably) phony revenue numbers. Washington pols always lie about those. Pay attention to:

“…[A]sking the wealthiest 2 percent…”

It’s important to note who those “wealthiest 2 percent” are.

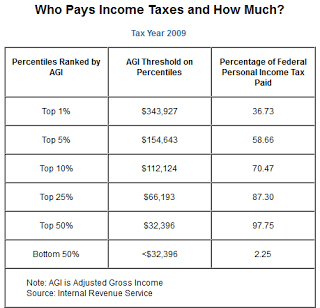

In fact the “wealthiest 2%” are the people who pay between 40-60% of all federal income taxes. This means the President and Democrats have declared a “victory” by raising taxes on the vast majority of the people who already pay most of the income taxes. A more accurate description of this would be to say that the President has raised taxes on “people who pay about half of all income taxes.”

This means that claim, “…[W]hile protecting 98 percent of families…” is playing with words at best. After you get done increasing taxes for more than 50% of the people who pay the taxes that leaves you the people who pay fewer than 50% of the taxes–not 98%. Note on the graph that the bottom 50% of earners pay only 2.25% (and probably less considering these are old numbers) of the income taxes. Therefore, many of the 98% of the people the President purports to be saving weren’t paying income taxes anyway.

Admit it, you’ve heard for years from Pelosi, Reid and Obama that the “Bush tax cuts” benefit only ‘the rich.’ If that’s true, then why did the President and Democrats do an about-face on protecting the Bush marginal tax rates for “the middle class”? Because they thought you wouldn’t check their math, that’s why. In fact, the Bush marginal tax rates cut taxes for the middle class and gave more refundable tax credits to the working poor. It’s just a fact. President Obama actually takes credit for giving the working poor more ‘refundable’ income tax credits through EITC, child tax credits. I’m not sure how much more the American people can “give away” considering it was George Bush who expanded those programs when he introduced the 2001 and 2003 reductions in marginal tax rates. Because of these extra spiffs, 8 million people on the lowest earning rung dropped off the federal income tax rolls entirely because in addition to the increases in federal help under the Bush administration, the people paying the lowest tax rates had their rate cut by 33% under the Bush tax cuts. The top rate was cut by 13%.

Also, the Bush tax rates brought as much if not more money into the federal coffers dollars and percentage wise. You kept more of your money and put it to what you believed is its highest and best use.

From Pete Ferrara writing in Forbes:

According to official IRS data, the top 1% of income earners paid $84 billion more in federal income taxes in 2007 than in 2000 before the Bush tax cuts were passed, 23% more. The share of total federal income taxes paid by the top 1% rose from 37% in 2000, before the Bush tax cuts, to 40% in 2007, after the tax cuts.

In contrast, the bottom half of income earners paid $6 billion less in federal income taxes in 2007 than in 2000, a decline of 16%. The share of federal income taxes paid by the bottom 50% declined from 3.9% in 2000 to 2.9% in 2007. [emph added]

On this next claim, “…[P]rotecting …97 percent of small businesses…” is unclear at this point. It stands to reason that it’s playing with words just like the “98%” figure is. The deal keeps the current marginal tax rates for couples earning more than $450K, so it’s possible this provision protects many small business which run their Sub Chapter S and LLC returns through personal income taxes. But it admits that the largest of these small businesses, employing likely the largest number of people, would be given tax increases. Any way you slice it that means people will lose their jobs. Why would the President do this? Because it’s not about jobs–it’s about sticking it to people who are “the rich” and making them pay more for being successful. You may see it differently, but I believe government should not be in the business of punishing people for striving for success. I think it’s a bad message to send and results in capital flight. A flatter tax system as recently espoused by the Simpson-Bowles Commission would we more desirable, fair and still encouraging of strivers.

Thank you for indulging me.